One Person Company Registration

One Person Company (OPC) is a unique business structure in India that allows a single individual to establish and operate a company. It provides limited liability protection while maintaining the simplicity of a sole proprietorship. OPCs enable entrepreneurs to start and manage a business independently, making it an attractive option for solo ventures.

₹4480excl. GST

OPC Registration Process in India - Registering a One Person Company

The introduction of the Companies Act, 2013 brought about the concept of the One Person Company (OPC). As the name suggests, an OPC is a company established and managed by a single individual. This new concept allows for the benefits of a company, such as perpetual succession, limited liability, and a separate legal entity.

Previously, before the enforcement of the Companies Act, a single person could not establish a company. Their options were limited to sole proprietorship, as a minimum of two directors and two members were required to establish a company.

A minimum of 2 directors and 2 members were required in a Private Company, while in a Public Company, a minimum of 3 directors and 7 members were needed. Therefore, an individual could not incorporate a company on their own.

However, according to Section 2(62) of the Companies Act 2013, a company can now be formed with just 1 director and 1 member, who can even be the same person. This type of company, known as a one person company, has fewer compliance requirements compared to a private company. It provides the opportunity for an individual, whether a resident or non-resident, to incorporate their business with the features of a company and the benefits of a sole proprietorship.

Advantages Of OPC:

1. Independent Legal Status:

The OPC is granted a separate legal entity status, providing protection to the individual who incorporates it. The member's liability is limited to their shares, shielding them from personal liability for the company's losses. Consequently, creditors can only sue the OPC and not the member or director.

2. Easy Fundraising:

Being a private company, the OPC can easily raise funds through avenues such as venture capitalists, angel investors, and incubators. Banks and financial institutions are more inclined to grant loans to companies rather than proprietorship firms, making it easier for the OPC to obtain funds.

3. Reduced Compliance Burden:

The Companies Act, 2013 grants certain exemptions to the OPC regarding compliance requirements. For instance, the OPC is not obligated to prepare a cash flow statement, and the company secretary does not need to sign the books of accounts and annual returns. These tasks can be accomplished solely by the director, simplifying the compliance process.

4. Simple Incorporation:

OPCs can be incorporated with just one member and one nominee. The member can also serve as the director. While a minimum authorized capital of Rs. 1 lakh is required, there is no minimum paid-up capital requirement. Consequently, OPCs are easier to incorporate compared to other forms of companies.

5. Easy Management:

The ability for a single person to establish and run an OPC ensures streamlined management. Decision-making processes are quicker, and the member can easily pass ordinary and special resolutions by recording them in the minute book and signing them personally. This eliminates internal conflicts and delays, making the company easy to manage.

6. Perpetual Succession:

Despite having only one member, the OPC enjoys the benefit of perpetual succession. During incorporation, the member appoints a nominee who will take over the company's operations in the event of the member's death.

Disadvantages Of OPC:

1. Limited for Small Businesses:

OPCs are suitable primarily for small business structures. The maximum number of members allowed in an OPC is always one, and additional members cannot be added to raise further capital as the business expands and grows.

2. Business Activity Restrictions:

OPCs are prohibited from engaging in non-banking financial investment activities or making investments in securities of other corporate entities. Additionally, they cannot be converted into companies with charitable objectives under Section 8 of the Companies Act, 2013.

3. Ownership and Management Overlap:

Since the sole member can also be the director, there is a lack of clear distinction between ownership and management in OPCs. This blur in roles may lead to unethical business practices, as the sole member has the authority to make and approve all decisions without checks and balances.

One Person Company (OPC) Registration Process

Step 1: Obtain DSC

To begin the process, you need to acquire a Digital Signature Certificate (DSC) for the proposed Director. The following documents are required for obtaining the DSC:

- Address proof

- Aadhaar card

- PAN card

- Photo

- Email ID

- Phone number

Step 2: Apply for DIN

Once the DSC is obtained, the next step is to apply for the Director Identification Number (DIN) of the proposed Director. This can be done by filling out the SPICe+ Form, which requires the name and address proof of the director. If you are applying for an existing company, you can use Form DIR-3 within the SPICe+ form to apply for the DIN. This streamlined process allows up to three directors to apply for DIN simultaneously.

Step 3: Name Approval Application

After obtaining the DSC and DIN, you need to decide on a name for the company. The approved name should follow the format "ABC (OPC) Private Limited". You can apply for name approval in the Form SPICe+ 32 application. Only one preferred name, along with the reason for choosing it, can be submitted. If the name is rejected, you can apply for another name using a new Form SPICe+ 32 application.

Step 4: Prepare Required Documents

The following documents need to be prepared and submitted to the Registrar of Companies (ROC):

- Memorandum of Association (MoA): This document outlines the company's objectives and the business it intends to pursue.

- Articles of Association (AoA): These by-laws define the operational rules for the company.

- Nominee Appointment: Since there is only one director and member, a nominee must be appointed to act on behalf of the director in case of incapacitation or death. The nominee's consent, along with their PAN card and Aadhaar card, must be submitted in Form INC-3.

- Proof of Registered Office: Provide proof of the proposed company's registered office, along with proof of ownership and a No Objection Certificate (NOC) from the owner.

- Director Declarations: The proposed director must submit a declaration in Form INC-9 and a consent form in DIR-2.

- Compliance Certification: Obtain a declaration from a professional certifying that all compliance requirements have been met.

Step 5: File Forms with MCA

Attach all the prepared documents, including the SPICe+ Form, SPICe-MOA, and SPICe-AOA, along with the DSC of the director and the professional. Upload these documents to the Ministry of Corporate Affairs (MCA) website for approval. The PAN and TAN numbers will be automatically generated upon incorporation, eliminating the need for separate applications.

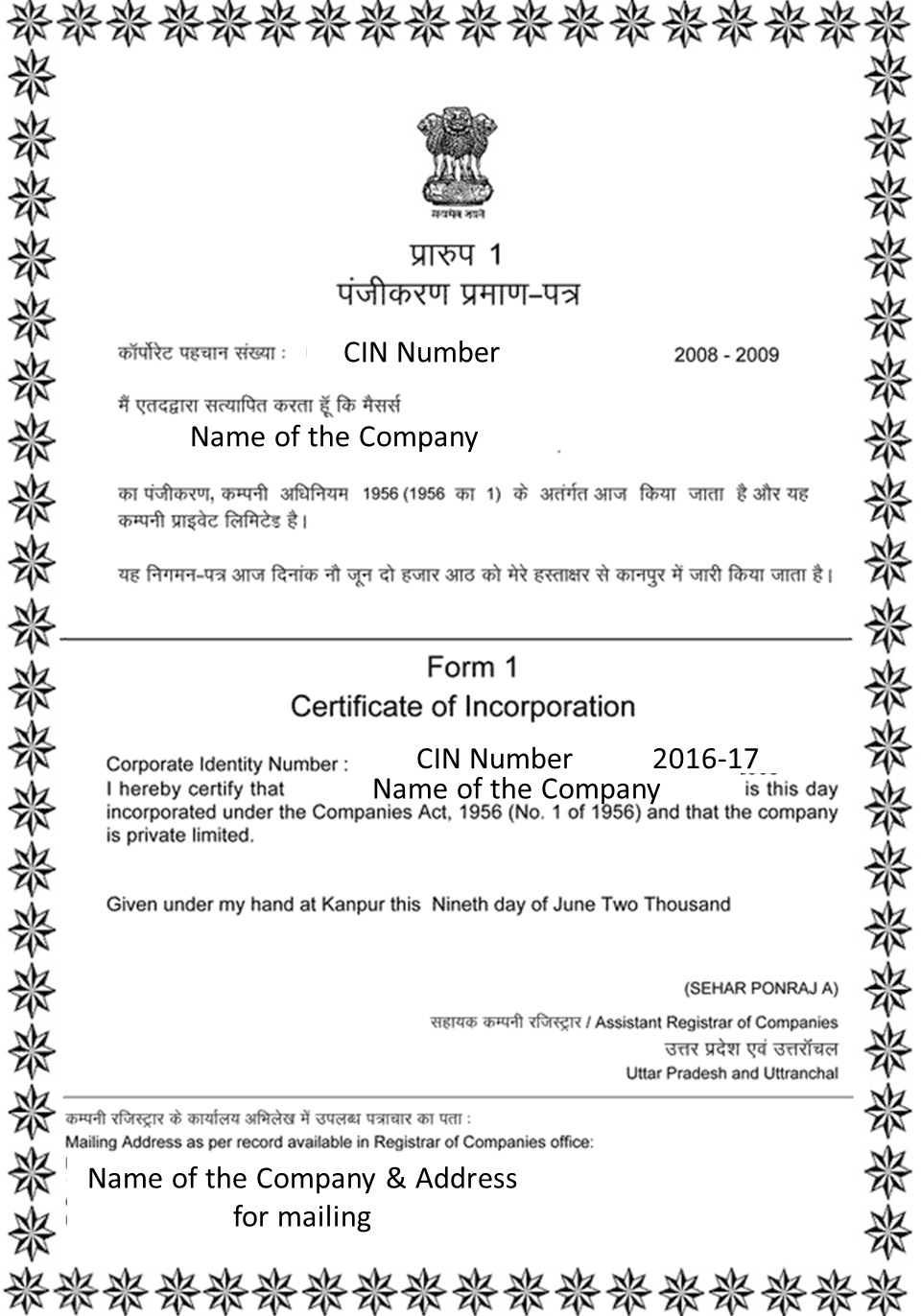

Step 6: Certificate of Incorporation

Upon verification, the Registrar of Companies (ROC) will issue a Certificate of Incorporation, allowing you to commence your business operations.

Checklist for Registering an OPC:

- Minimum and maximum of one member

- Appoint a nominee before incorporation

- Obtain the nominee's consent through Form INC-3

- Select a name for the OPC compliant with the Companies (Incorporation Rules) 2014

- Minimum authorized capital of Rs. 1 lakh

- Obtain the DSC of the proposed director

- Provide proof of the OPC's registered office

OPC Registration Timelines:

Obtaining the DSC and DIN usually takes one day, and the Certificate of Incorporation for an OPC is typically issued within 3-5 days. The entire process of incorporating an OPC usually takes around 10 days, depending on departmental approval and responses.

Frequently Asked Questions (FAQ):

- Holding at least one Board Meeting in each half of the calendar year, with a minimum time gap of 90 days between the two meetings.

- Maintaining proper books of accounts.

- Conducting a statutory audit of financial statements.

- Filing business income tax returns annually before September 30th.

- Filing Financial Statements in Form AOC-4 and ROC Annual Return in Form MGT 7.

1. Who is eligible to be a member of a One Person Company (OPC)?

Only an Indian citizen who is a natural person and resides in India is eligible to act as a member and nominee of an OPC. "Resident in India" refers to a person who has stayed in India for at least 182 days during the preceding financial year.

2. Can a person be a member of more than one OPC?

No, a person can be a member of only one OPC.

3. Are there any tax advantages to forming an OPC?

An OPC does not have any specific tax advantages compared to other types of companies. The tax rate is a flat 30%, and general tax provisions like Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT) apply, just as they do to any other company.

4. Is there a threshold limit for an OPC to be mandatorily converted into a private or public company?

No, the requirement for compulsory conversion of an OPC upon exceeding the minimum paid-up capital and average annual turnover was removed in the Companies (Incorporation) Second Amendment Rules, 2021. Therefore, currently, an OPC is not required to convert into a private or public company based on an increase in its paid-up capital and average annual turnover.

5. What are the mandatory compliance requirements for an OPC?

The basic mandatory compliance for an OPC includes:

6. Who cannot form an OPC?

Minors, foreign citizens, non-residents, and individuals incapacitated by contract are not eligible to become members of an OPC.

7. How can I convert an OPC into a Private Limited Company?

An OPC can be voluntarily converted into a private limited company by passing a special resolution and increasing the minimum number of members and directors to two. Additionally, a written No Objection Certificate (NOC) must be obtained from creditors for the conversion. You can click here to learn more about the conversion process.

Disclaimer:

The information provided here is for informational purposes only. Accessing or using the site or the materials does not create an attorney-client relationship. The information presented on this site should not be considered legal or professional advice and should not be relied upon as a substitute for advice from a licensed attorney in your state.

Need One Person Company Registration service?

If you require One Person Company (OPC) registration services in India, consider engaging professional assistance. They can guide you through the entire process, including documentation, compliance requirements, and filing. Benefit from their expertise to ensure a smooth and efficient registration of your OPC, saving you time and effort.

Buy Now Talk to AdvisorStartup India Services

Our 16+ services were built for specific problems, pain points, and needs in every corner of your enterprise.

Startup India Registration

Startups in India can access government benefits like tax exemptions, funding, and mentorship programs.

Startup India Tax Exemption

Startup India provides tax exemption for eligible startups for 3 out of their first 10 years since incorporation.

One Person Company

One Person Company (OPC) is a legal business structure in India that allows a single individual to operate a company with limited liability.

Limited Liability Partnership

LLP is a business structure in India providing limited liability protection and operational flexibility to partners.

Private Limited Company

A Private Limited Company in India offers limited liability protection and requires at least two directors and shareholders.

ISO Registration

ISO registration certifies compliance with international standards, boosting a business's credibility and competitiveness.

FSSAI Registration

FSSAI registration is mandatory for food-related businesses in India to comply with food safety regulations and build consumer trust.

Digital Signature

A digital signature is a cryptographic tool that verifies the identity and integrity of electronic documents or messages.

Section 8 Company Registration

Section 8 Company registration incorporates nonprofits in India for charitable or social purposes.

IEC Code

IEC code is a unique 10-digit identification number required for businesses engaged in import or export activities in India.

NGO Registration

NGO registration is the process of legally establishing a nonprofit organization in India to carry out social or charitable activities.

Trust Registration

Trust registration is the process of legally establishing a charitable or philanthropic trust entity in India.

Society Registration

Society registration is the process of legally establishing a nonprofit organization for social, cultural, or charitable activities in India.

Partnership Firm Registration

Partnership firm registration is the process of legally establishing a partnership business entity in India.

Share Transfer

Share transfer is the process of transferring ownership of shares from one party to another in a company.

MSME / UDYAM Registration

MSME/UDYAM registration enables micro, small, or medium enterprises in India to access government benefits and support.

A Price That Fits Your Needs

Develop a pricing strategy by understanding costs, researching your target market, setting objectives, analyzing competitors, implementing value-based pricing, testing different models, and monitoring and adjusting as needed.

We solve real business challenges.

Our 14+ services were built for specific problems, pain points, and needs in every corner of your enterprise.

Web Development

We design and develop creative, responsive, outstanding, agile website with our microscopic detailing and scrupulous strategies.

App Development

We're designing & developing for both android and ios users with proper brainstorming and excellent knowledge of UX/UI with the latest technologies.

Digital Marketing

Target, engage, interact, and deliver. Digital marketing, social media, and advertising that is tailored to a custom strategy designed for results.

Helping Businesses in All Sectors

A blend of contributions to meet every one of your prerequisites